Your ITIN, Your Money

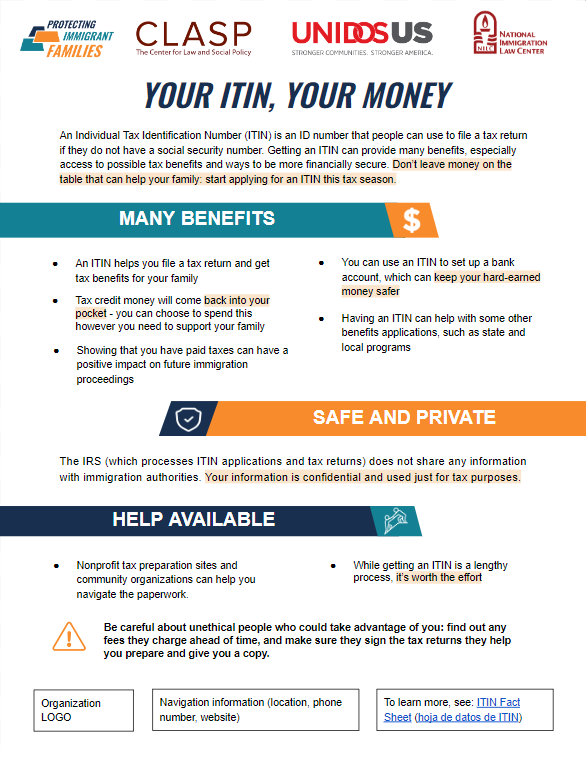

PIF, along with partners NILC, UnidosUS, and CLASP, have joined together to develop materials that show the benefits of ITINs and tax filing in immigrant communities, and equip community based organizations and outreach workers to motivate their communities to do so. The number of states providing accessible state-based tax benefits for ITIN holders continues to expand as well, making tax filing for immigrants an economic stability opportunity for more and more immigrant families.

PIF, along with partners NILC, UnidosUS, and CLASP, have joined together to develop materials that show the benefits of ITINs and tax filing in immigrant communities, and equip community based organizations and outreach workers to motivate their communities to do so. The number of states providing accessible state-based tax benefits for ITIN holders continues to expand as well, making tax filing for immigrants an economic stability opportunity for more and more immigrant families.

Millions of immigrant families missed out on vital economic supports during the pandemic, including the enhanced Child Tax Credit payments, because they lacked an Individual Tax Identification Number (ITIN) or had not filed Federal income taxes. The challenging ITIN application process, coupled with confusion and fear about the safety and security of filing taxes, present an almost overwhelming barrier to immigrant families.

The links below will prompt you to create a copy of each flyer. Once you do, you will be able to customize the content for your organization without affecting the original. Versions available:

This promotional toolkit includes digital and social media promotional tools, background information for outreach workers, and more. We encourage you to use it to raise ITIN awareness in your community.

Note: We update materials for the community whenever policy changes. These materials reflect the federal policy currently in effect.